"Sn210" (sn210)

"Sn210" (sn210)

09/16/2015 at 11:57 ē Filed to: Stocklopnik

0

0

12

12

"Sn210" (sn210)

"Sn210" (sn210)

09/16/2015 at 11:57 ē Filed to: Stocklopnik |  0 0

|  12 12 |

I was Googling where the closest AutoZone was to run to at lunch when I noticed their stock ticker in the results. Holy crap, $730/share?!?! And they were trading for $200 just 5 years ago? Damn.

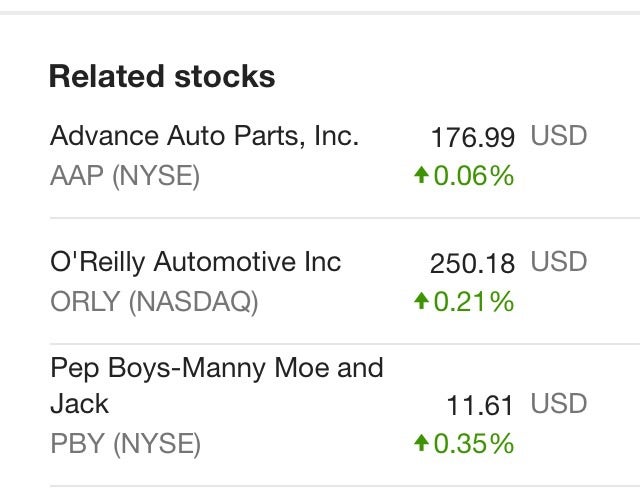

Other stores are up there too...

Well except for Pep Boys

Ash78, voting early and often

> Sn210

Ash78, voting early and often

> Sn210

09/16/2015 at 12:03 |

|

The actual share price is mostly meaningless, but I think optically itís time for a split. If their investors are mostly institutional, itís purely about valuation and not the share price itself ó they buy block of thousands or millions at a time. The only real reason to artificially force the price down is to get more mom & pop investment.

On the other hand, stocks can be fairly valued under $10 and the company might be perfectly profitable, but theyíd be at risk of being de-listed from their exchange.

Those are about the only two reasons to care about share price.

Just look at Warren Buffetís Berkshire Hathaway shares:

$200,000 per share for ďAĒ shares

$132 for ďBĒ shares

RustedSprinter

> Sn210

RustedSprinter

> Sn210

09/16/2015 at 12:03 |

|

Pep boys is only 11 bucks a share? Wow

jariten1781

> Sn210

jariten1781

> Sn210

09/16/2015 at 12:08 |

|

But thatís only half the cost of Priceline (share prices baffle me).

If only EssExTee could be so grossly incandescent

> Sn210

If only EssExTee could be so grossly incandescent

> Sn210

09/16/2015 at 12:10 |

|

NAPAís price is just about $86 right now.

Sn210

> Ash78, voting early and often

Sn210

> Ash78, voting early and often

09/16/2015 at 12:11 |

|

Yeah I know it's not always a good investment just because it's expensive, but still I wasn't expecting them to be that high

Sn210

> jariten1781

Sn210

> jariten1781

09/16/2015 at 12:11 |

|

You and me both

Sn210

> If only EssExTee could be so grossly incandescent

Sn210

> If only EssExTee could be so grossly incandescent

09/16/2015 at 12:12 |

|

See that's the range I would have guessed they'd all be.

Ash78, voting early and often

> Sn210

Ash78, voting early and often

> Sn210

09/16/2015 at 12:15 |

|

The investment is equally good (or bad) whether itís 1 share at $780 or 100 shares at $7.80

Share price means nothing unless you look at it against P/E or P/FCF or something like that. Only the multiple counts.

Mr. Ontop, No Strokes, No Smokes...Goes Fast.

> Ash78, voting early and often

Mr. Ontop, No Strokes, No Smokes...Goes Fast.

> Ash78, voting early and often

09/16/2015 at 12:40 |

|

Iím too lazy to run the numbers. How does their price do when P/E is reflected?

SidewaysOnDirt still misses Bowie

> Sn210

SidewaysOnDirt still misses Bowie

> Sn210

09/16/2015 at 13:09 |

|

I donít believe for a minute that some of these valuations are real. It seems like mergers and cost cuts have been the drivers for the last few earnings seasons, which isnít sustainable and their P/E ratios are at tech levels. Sorry, but Advanced Auto Parts isnít a $15bil company. Itís just not.

SidewaysOnDirt still misses Bowie

> Sn210

SidewaysOnDirt still misses Bowie

> Sn210

09/16/2015 at 13:15 |

|

The prices donít really matter as theyíre divided by the number of shares to show the valuation of the company. A company can have a $1000 share price and be worth less than something with a $5 share price if there arenít enough shares. For example, AAP is at $178 with a market cap roughly $15bil while Ford is sitting at $15 per share with a market cap of about $60bil or worth four times as much. The reason is that there are 4 billion Ford shares while there are only 73

million

shares of Advanced auto parts out.

Ash78, voting early and often

> Mr. Ontop, No Strokes, No Smokes...Goes Fast.

Ash78, voting early and often

> Mr. Ontop, No Strokes, No Smokes...Goes Fast.

09/16/2015 at 13:28 |

|

Iím lazy, too ó the screencap shows a P/E of 21, which isnít far from the long-term historical market norm of (I think) 15. Tech stocks are often valued more highly due to growth prospects, but 21 for a retailer isnít crazy at all. Nothing to see here :D